Highlights

- Boab Metals continues to advance its flagship Sorby Hills Lead-Silver-Zinc Project in WA.

- The Company executed a Heads of Agreement (HOA) to source reliable and cleaner power for the project.

- BML has invited EPC tenders from engineering firms for developing project-related infrastructure.

- The Company has received amendments to the EPA approval from regulatory authorities.

- BML reported a cash balance of AU$6.4 million as at 30 June 2022.

ASX-listed Boab Metals Limited (ASX:BML) is committed to developing Sorby Hills Lead-Silver-Zinc Project in Western Australia. Boab has released its quarterly activities report for the period ending 30 June 2022.

Boab operates one of the largest undeveloped near-surface lead-silver deposit in Australia. Lead is a proven battery metal and is one of the primary components of 12V batteries used in electric vehicles.

The Sorby Hills Project holds 494kt of lead and 17.6Moz of silver as open pit reserves. The project is located close to the existing infrastructure and the Company is currently undertaking a Definitive Feasibility Study.

Silver is best-known as a conductor of electricity and is also a good conductor of heat, making it ideal to be used in solar panels and automobile circuits. Nearly 50% of the silver produced globally is consumed for industrial purposes.

Boab is on the path to gaining significant exposure to the exciting battery mineral market. The June quarter saw the Company make progress on a slew of activities in line with its goal. During the quarter, the Company continued to advance the development works on the project, including EPC tendering, power sourcing, EPA approvals and many more milestones.

Major operational highlights of June quarter

Heads of Agreement for power supply

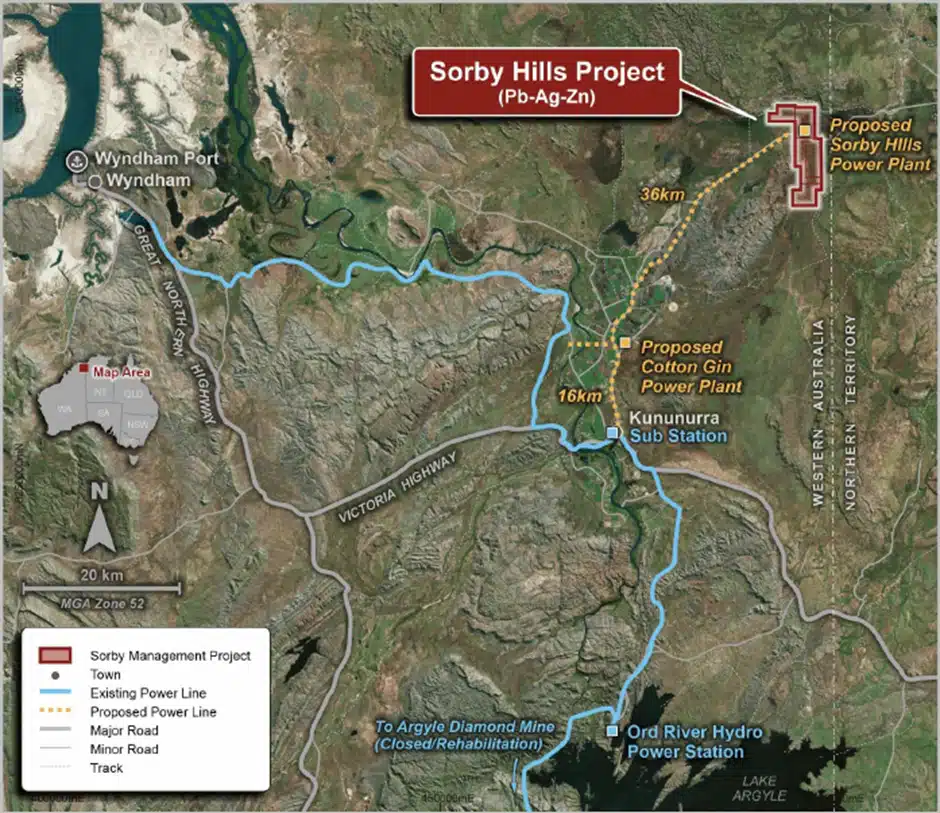

Boab executed a Heads of Agreement (HOA) with Horizon Power for supplying reliable, cleaner and cheaper power for a 10-year term, with an option for Boab to extend the agreement. Horizon will be supplying electricity generated from Pacific Hydro Australia’s Ord River Hydroelectric Plant.

Sorby Hills Project location with respect to Ord River Hydro Power Station (Image source: Company update, 11 July 2022)

Horizon plans to power the project through a combination of hydropower and an on-site back up diesel plant.

BML undertook a preliminary supply and price modelling for using an integrated hydro-diesel power solution. The modelling indicated that its integrated solution would provide lower unit cost as compared to the diesel-only solution assumed in the PFS.

EPC Contract Tender

Boab has invited tenders from experienced engineering firms for EPC Contracts for processing and non-processing infrastructure on the project. For the Pre-Feasibility Study (PFS), Boab had considered 1.5Mtpa capacity for its processing plant, while the Sorby Hills Definitive Feasibility Study (DFS) investigated an expanded process plant capacity.

Boab is currently shortlisting eligible tendering applications. The price quoted in the tenders will underpin the capital cost included in the DFS, providing a higher level of accuracy.

Amendments to the EPA

At the end of the quarter, Boab received a confirmation from the Environmental Protection Authority (EPA) of WA on the amendments to Boab’s existing EPA approval. The approval is a prerequisite to kick off early works and site establishment.

Boab has consciously adopted a multi-stream approvals strategy to de-risk the project execution schedule.

The Company is waiting on approvals under the Biodiversity Conservation Act 2016 and from DMIRS (Department of Mines, Industry Regulations and Safety) to start the work on awarding contracts for site establishment and early works. Boab expects to secure approvals in the coming weeks.

Update on the DFS

Boab is currently working towards wrapping up the ongoing Definitive Feasibility Study (DFS). The Company is incorporating prices from the tendered documents to get a more accurate and clearer picture of the capital and operating costs of the project.

Also, the decision pertaining to the production under the offtake agreements will closely follow the release of the DFS. The findings of the DFS will help to evaluate the offtake terms with more accuracy. It will also aid in making decision on how the offtake debt facilities will align with the potential debt facilities from commercial banks and the Northern Australian Infrastructure Facility (NAIF).

The Company estimates the DFS to be completed in the second half of 2022.

Boab has already executed an agreement with Cambridge Gulf Limited in respect to access and stevedoring services at Wyndham Port. The agreement will facilitate the storing, loading and shipping of the concentrates produced at Sorby Hills for potential offtake customers.

Wyndham Port (Image source: Company update, 31 March 2022)

Cash & Financials

At the end of 30 June 2022, Boab Metals reported a cash balance of AU$6.4 million. The Company is well funded to progress Sorby Hills Project through Final Investment Decision (FID).

Keep up to date with Boab Metals by following them on their Linkedin page here: #BoabMetals

Source: Copyright © 2022 Kalkine Media®