Highlights

- Boab Metals continued directing its efforts towards reaching a Decision to Mine at Sorby Hills during the December 2022 quarter.

- As per the recent Sorby Hills DFS study, around 75% of the pre-production capital expenditure and direct mining costs are supported by the present tendered pricing.

- ~18.3Mt of ore will be mined and processed through a simple crush-mill-flotation circuit at an initial rate of 1.5Mtpa expanding over the initial 8.5-year processing period.

- Over the Life of Mine, nearly AU$705 million of pre-tax free cash flow will be generated.

- Boab has appointed GRES as its new EPC contractor to deliver the 2.25mtpa Sorby Hills Project Process plant.

- As per assay results from Phase VI program at Sorby Hills, hole SHRC_149 finished in very high-grade mineralisation (2m at 10.92% Pb & 163g/t Ag from 103m).

ASX-listed exploration and development company Boab Metals Limited (ASX: BML) has been on a persistent drive towards reaching a Decision to Mine at its Sorby Hills Project. The December quarter saw the company’s efforts directed and focussed towards the same objective. In this article, we will elaborate on the key developments from quarter ending 31 December, 2022.

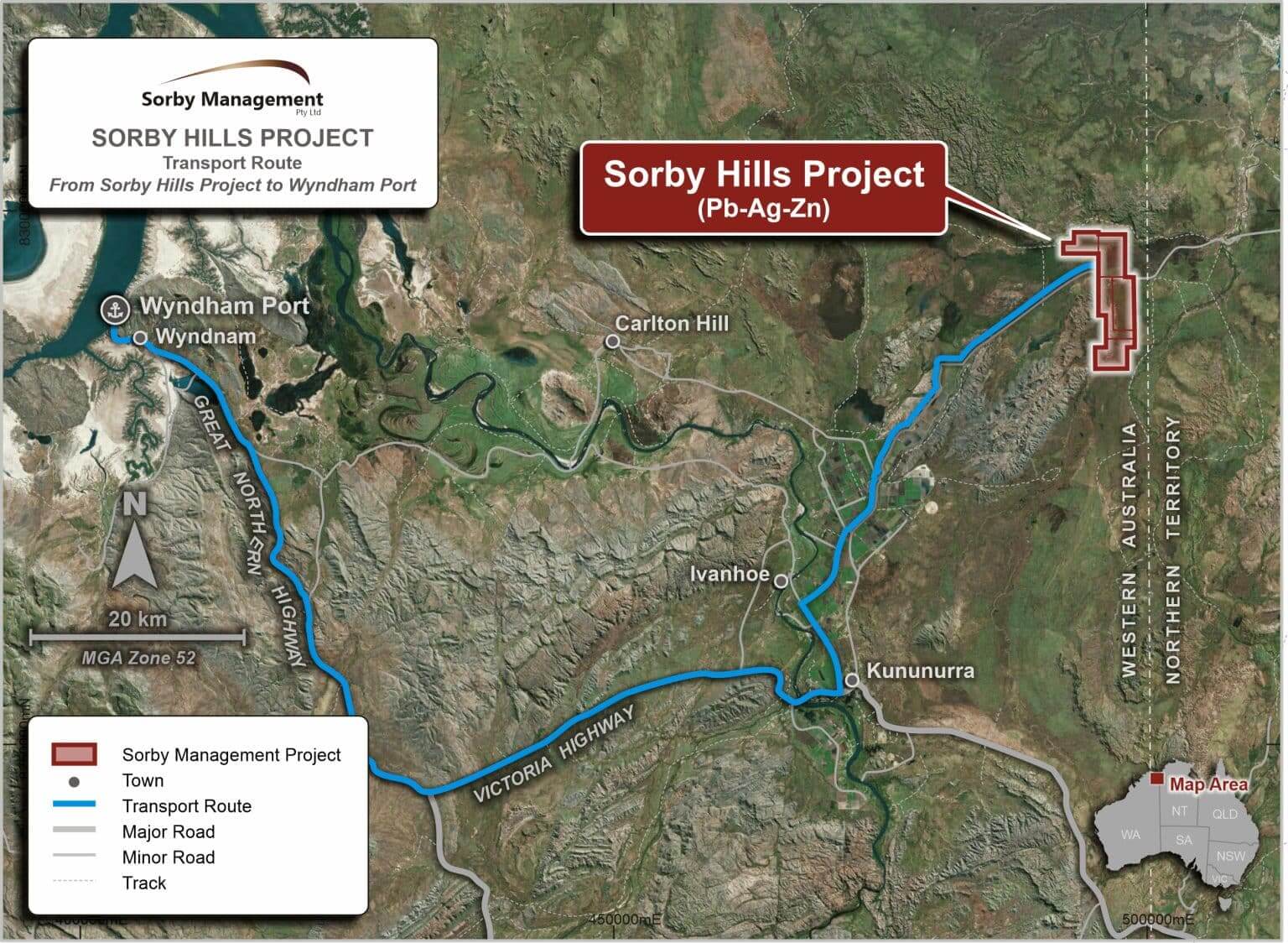

Sorby Hills, located in the Kimberley Region of Western Australia, is 75% owned lead-silver-zinc project of Boab Metals, while the remaining 25% (contributing) interest is owned by Henan Yuguang Gold & Lead Co. Ltd. The project is based 50km from the regional centre of Kununurra in the East Kimberley Region of Western Australia.

Image source: Company update

Data source: Company update

Definitive Feasibility Study

Recently, Boab Metals announced the results of the Sorby Hills Definitive Feasibility Study (DFS). According to the company release, around 75% of the pre-production capital expenditure and direct mining costs are supported by the present tendered pricing.

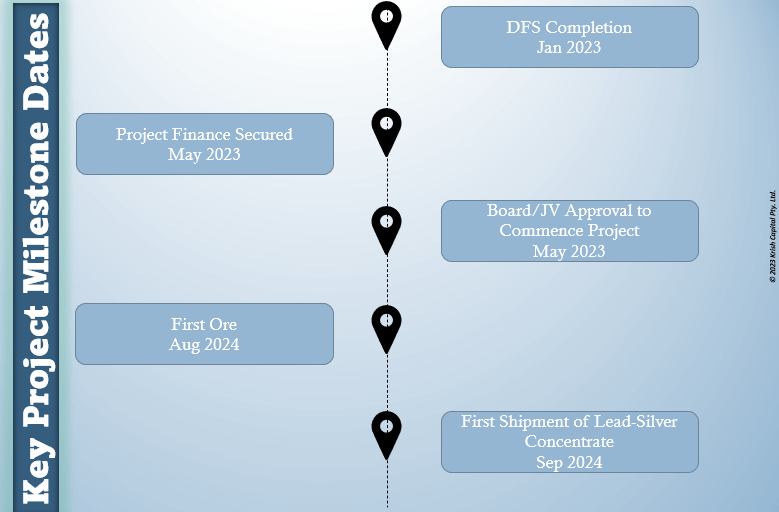

Data source: BML update, dated 19 January 2023

Approximately 18.3Mt of ore will be mined and processed through a simple crush-mill-flotation circuit at an initial rate of 1.5Mtpa over the initial 8.5-year processing period contemplated by the DFS. This will be increased to 2.25Mtpa post one year of production.

Around 103ktpa (average) of concentrate will be produced. This will consist of 64ktpa of payable Lead and 2Moz p.a. of payable Silver. The concentrate produced will be transported in containers ~150km to Wyndham Port by road. It will be further shipped to market from the port.

Over the Life of Mine, nearly AU$705 million of pre-tax free cash flow will be generated. Also, it will lead to an average annualised EBITDA of AU$119 million per annum during operations. The company has calculated pre-production capital expenditure to be at AU$245 million, while net C1 Cash Costs is expected to stand at US$0.39/lb payable Lead.

The Project generates a pre-tax NPV8 of A$370M and an IRR of 35% (from the start of construction) and a payback period of 2.5 years (from the start of operations).

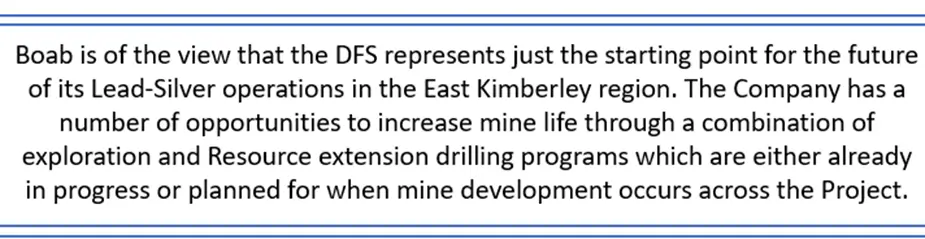

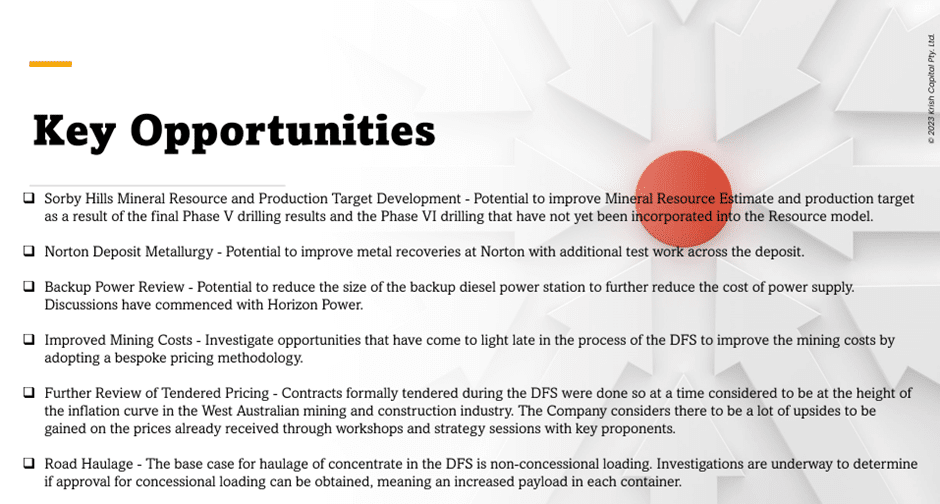

Boab considers the DFS to be the starting point for the future of its Lead-Silver operations in the East Kimberley region. Through a mix of ongoing and planned exploration and resource extension drilling programs, Boab expects multiple opportunities to come its way that will help in extending the mine life.

Data source: Company update

Sorby Hills Ore Reserve Statement

During the quarter, Boab also announced the revised Ore Reserve Statement for the Sorby Hills Project declared by independent mining consultants Entech Pty Ltd following the JORC Code 2012. The 15.2Mt Ore Reserve is a subset of the 18.3Mt DFS Mining Inventory, marking an increase of about 12% versus earlier Ore Reserve estimate of 13.6Mt for the Project.

GRES: Boab’s new EPC contractor

Boab has appointed GRES, one of the market-leading engineering firms, as its new EPC contractor for the 2.25mtpa Process plant of the Sorby Hills Project. GRES is known for its technical expertise and track record of project delivery.

According to the company release, there is a possibility that Sorby Management Pty Ltd and GRES may enter into an EPC contract after Final Investment Decision (FID) is declared for the Project.

Until FID is reached on the Project, Sorby Management and GRES will work together to execute a Detailed Design and Procurement Agreement.

Post quarter developments

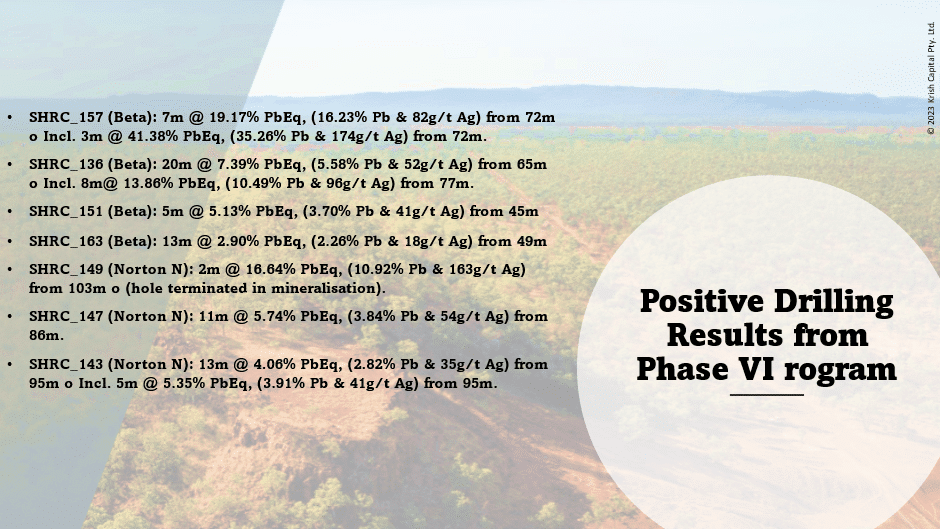

Boab received the final assay results from its phase VI drilling campaign in January 2023. The program was aimed to enhance the value of the later stages of the mine plan at Sorby Hills.

The company is of the opinion that the results of the Beta deposit may have a positive impact on the future Resource estimates. It will allow an improved Resource classification as well as inclusion of a larger proportion of the Beta Mineral Resource into the Ore Reserve. This will further support the plan for another drilling program for resource expansion.

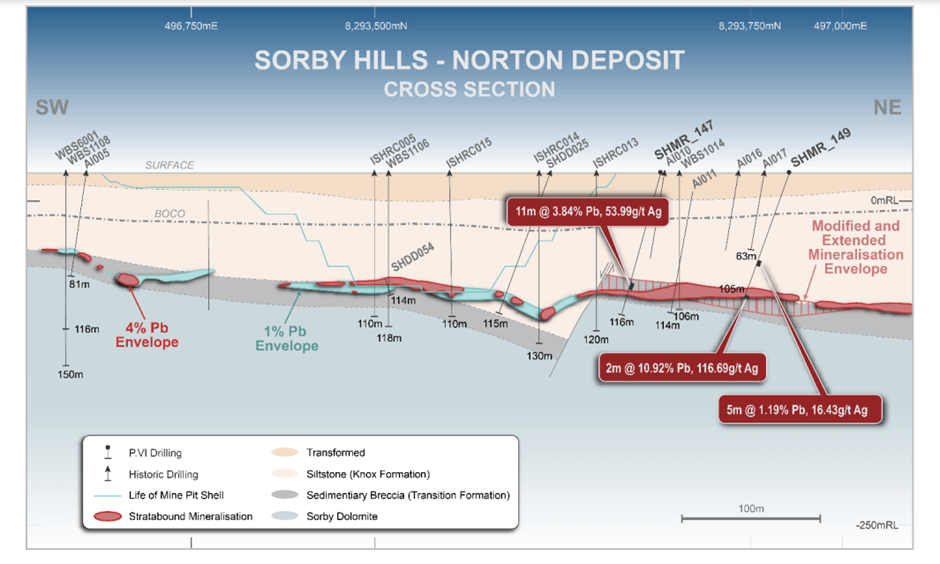

Also, Boab believes that tighter drill hole spacing on the northern periphery of the Norton deposit may fill the interpreted continuity gap in the high-grade zone. It may allow its inclusion in a future mine plan update.

The Phase VI program assay results saw the hole SHRC_149 finish in very high-grade mineralisation (2m at 10.92% Pb & 163g/t Ag from 103m). Earlier, hole SHRC_149 was terminated due to poor ground conditions. Boab will conduct diamond drilling at this hole during the year.

One interval of 9m at 220ppm Pb and about 100ppm Zn in EMRC_005 from 121m has also been identified at Eight Mile Creek during drilling. The absolute values are nearly 10 times the background threshold value of around 20ppm Pb in unmineralised bedrock. Data is yet to be analysed for exploration plans in this area.

Data & image source: Company announcement

Norton Cross Section trending NE showing the position of recently completed drill holes, intercepts and reinterpreted outline of the mineral resource envelopes.

Source: Kalkine Media®