HIGHLIGHTS

- Recent work undertaken by Boab Metals are driven towards reaching a Final Investment Decision to Mine at its 75%-owned Sorby Hills Project.

- An updated pre-feasibility Study (PFS) on Sorby Hills released during the FY 2021 confirmed the economic robustness of the project.

- Sorby Hills’ Definitive Feasibility Study (DFS) is due for delivery in the first half of 2022.

Boab Metals Limited (ASX: BML) achieved significant progress during FY2021. The financial year commenced with the delivery of a robust Pre-Feasibility Study (PFS) for Sorby Hills. Over the FY, the company undertook meaningful exploration programs and also commenced metallurgical testwork program in February 2021.

ALSO READ: Boab Metals’ (ASX: BML) Sorby Hills access set to significantly improve with Moonamang Road upgrade

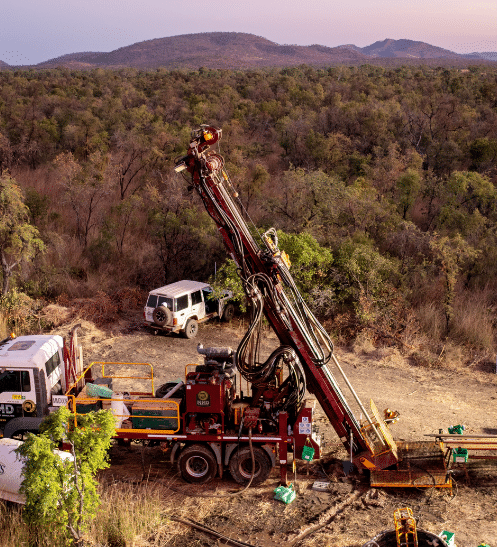

During FY 21, Boab has advanced the 75%-owned Sorby Hills Lead-Silver-Zinc Project with the goal of allowing Boab’s board to reach a Decision to Mine. The project is located within the Kimberley Region of Western Australia and the company is currently working towards delivering a Definitive Feasibility Study (DFS) which is due for delivery in the first half of 2022. With this backdrop, let us look at the key highlights of FY21.

RELATED ARTICLE: Boab Metals attends Diggers & Dealers mining forum, company points to a bright future

Pre-Feasibility Study highlights economic viability

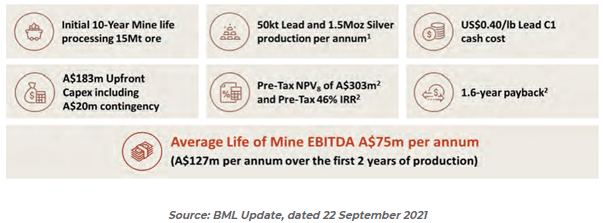

An updated Pre-Feasibility Study (PFS) on Sorby Hills was released in August 2020, confirming an economically robust project. The study highlighted that pre-production capex of AU$183 million would be paid back from outstanding early cash flows within 1.6 years.

Conservative commodity price assumptions underlined the project NPV and IRR at AU$303 million and 46%, respectively, while, the project life is estimated to be 10 years, including AU$127 million of average EBITDA over the first two years of operations.

Outstanding PFS results have given Boab Metals and its JV partner confidence to progress to a Definitive Feasibility Study (DFS).

Phase IV bolsters Interim Mineral Resource Estimate

Success of the Phase IV drilling program focussed on securing metallurgical and geotechnical information to support the DFS. The interim Mineral Resource Estimate at the project stands at 44.9Mt at 3.2% Pb, 0.5% Zn and 37g/t Ag.

The updated mineral resource estimate led to an increase in Measured and Indicated Tonnes of 1.3Mt (6%), 24Kt contained Lead (3%), and 1.2Moz contained Silver (5%). Measured Resources increased by 56% while there was also a significant increase in shallow Resource tonnes.

Encouraging outcomes continue for Phase V program

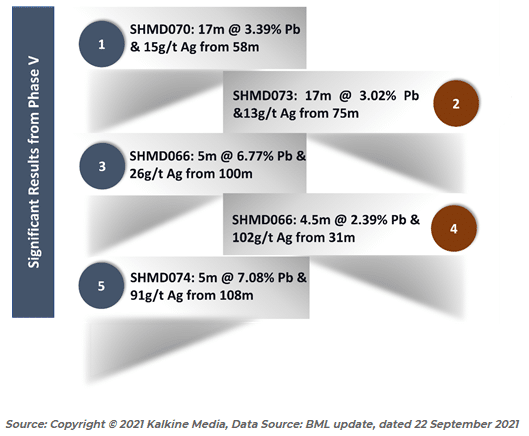

Results from the Phase IV program confirmed several material extensions beyond the proposed open pits in PFS. These results provided Boab with confidence to undertake a further phase V drilling program, focused on investigating the potential for mining and processing capacity expansion in the DFS.

The Phase V drilling program kicked off in May 2021 with a planned objective to complete at least 4,200m across 48 holes with specific targets. Subsequent to FY21, encouraging results from the Phase V campaign have been reported which are expected to contribute to an increased mining inventory at Sorby Hills.

RELATED ARTICLE: Boab Metals (ASX:BML) reports exciting initial results at Sorby Hills

Manbarrum Project Acquisition to complement regional production strategy

In July 2021, Boab acquired a 100% stake in the Manbarrum Zinc-Silver-Lead Project, located approximately 25km east of the Sorby Hills Project.

READ MORE: Boab Metals Limited (ASX:BML) snaps up Manbarrum Zinc-Lead-Silver Project to expand resource base

Boab now plans to investigate how Manbarrum project could be incorporated into the Company’s regional production strategy.

ALSO READ: Eye on Sorby Hills DFS, Boab Metals (ASX:BML) makes serious strides in June quarter

Corporate Initiatives

Boab has remained actively engaged with government funding agencies such as NAIF and EFA, as well as commercial banks. At the same time, the Company is advancing negotiations with several potential off-take partners as the Sorby Hills Project advances towards a final investment decision in the first half of CY2022. During FY21, the Company also changed its name to Boab Metals Ltd from Pacifico Minerals Limited to better reflect its commitment to the Kimberley region.

Bottom Line

Several initiatives, including a range of technical, project execution, and corporate activities, have provided a springboard for the company’s growth. Boab Metals cash position at the end of FY2021 was AU$12.9 million. The Company is well placed to advance and execute project workstreams, which would deliver a high-quality DFS and move swiftly towards a decision to mine.