Boab Metals has recently completed an impressive pre-feasibility study for its flagship Sorby Hills lead-silver project in WA’s Kimberley region that is set to start up in 2023.

Lead is playing a crucial part in the growth of electric vehicles (EVs), with most light-duty EVs likely to feature either a 12-volt lead ignition battery or auxiliary battery for the foreseeable future, said Boab Metals (ASX:BML) Managing Director Simon Noon.

“There is a full-sized lead battery in almost all EVs, and this is often missed by people,” said Noon.

Auxiliary lead acid batteries provide power to EV engine management and vehicle safety systems and come on top of their on-board lithium-ion batteries for which EVs are famous.

New stop-start technology for conventional vehicles as well as EVs typically requires batteries with 25 per cent more lead content.

Boab Metals is rapidly moving ahead with the development of its Sorby Hills project and will produce a single concentrate product which will also contain a very significant amount of silver, an in-demand metal for industrial and investment markets.

“Lead is a market that is already strong with an annual growth rate of five to six per cent, and the market for lead batteries providing uninterrupted power is growing,” Noon said.

“Having spent the last few weeks talking with some of the largest off-takers in the world, I can assure you lead is not dead and the demand for our product will be strong,” he added.

Low risk and high quality project

The Sorby Hills project located 50km outside Kununurra comprises a mineral resource of 1.5Mt lead metal, and 54 million ounces of silver.

A recently completed pre-feasibility study for Sorby Hills outlined a production rate for the project of 50,000 tonnes per year of lead and 1.5 million ounces per year of silver.

The study confirmed the project as a strong, low risk base metal project with significant silver exposure that has a pre-tax net present value of $303m and would cost $183m to build with a very impressive 1.6 years to pay back.

The company has engaged the Northern Australia Infrastructure Facility (NAIF) with the aim of having them provide a significant portion of the total capital required.

The project has passed the strategic assessment with NAIF and they are now completing their due diligence.

In its initial two years of operation the Sorby Hills project is forecast to generate $127m per year in EBITDA, and an average EBITDA of $75m over the initial 10-year mine life.

Recent drilling has opened up some very interesting opportunities to expand the mining inventory at the Sorby Hills’ deposit and a fully funded definitive feasibility study for the project is now underway.

Assay results have confirmed up and down-dip extensions of mineralisation at the project outside of the current pit shells and further drilling could materially increase the mining inventory of Sorby Hills.

The company will test these target areas with an upcoming 6000m drill program that is expected to start in early May when the wet season finishes and will be funded from its $14m plus of cash on hand.

The project’s lead and silver resource is high quality and close to the surface with mineable ore from just 20m from surface and completely flat ground making it easy to mine.

Boab Metals’ board has executives experienced in building and funding mines including its chairman, Gary Comb, who was involved in bringing online Jabiru Metals’ (ASX:JML) Jaguar copper mine that was later sold to IGO (ASX:IGO).

Boab’s chief operating officer, David English was construction manager of Sandfire Resources (ASX:SFR) De Grussa copper mine, and for IGO’s Nova nickel mine.

Sorby Hills’ lead-silver project has Wyndham port for its concentrate exports. Image: company supplied

WA’s Wyndham port is accessible for the project

Shipments from the project would go through Wyndham, only 150km away and the port has handled metal concentrates for many years.

Lead and silver concentrate product from the Sorby Hills project will have an average grade of 62 per cent lead and 580 grams per tonne for silver and is destined for off-take customers.

This includes Boab Metals’ joint venture partner, Henan Yuguang Gold and Lead Company, the world’s largest lead smelting company and China’s largest silver producer.

The Chinese company owns 25 per cent of the project and covers 25 per cent of Boab Metals’ costs in the Sorby Hills project under its joint venture agreement.

“Clearly our joint venture partner has the capacity to take all of our potential production, but of course we are likely to have several different customers,” said Noon.

Interestingly, one of the largest lead smelters in the world is actually located here in Australia, at Point Pirie in South Australia.

Shipments from the Sorby Hills project would be worth $303m in net present value cashflow on a pre-tax basis.

Lead buyers express supply concerns

Lead’s price has been relatively stable recently, but buyers are starting to express concerns about a perceived lack of new supply sources for the base metal.

The London Metal Exchange’s futures contract for the base metal for delivery three months ahead was trading this week at $US2,050 per tonne.

“Off-takers and metals traders cannot see where marginal supply will come from because some zinc mines went offline with the lower pricing we seen early last year, and lead is usually produced as a credit or by-product of zinc production,” said Noon.

Over recent years china has raised its quality standards for lead imports and has reduced the allowable level of arsenic in lead in-concentrate shipments, leading to some shipments being turned away.

Traders and off-takers are therefore seeking higher quality lead concentrate like Boab Metal’s product to blend with lower quality material to ensure arsenic levels meet required import standards in China.

Bonus silver resource on top of lead

Silver represents about 25 per cent of the revenue stream from the Sorby Hills mine based on the PFS, thereby giving investors exposure to this high demand metal.

“I believe this project represents a great hedge because we have a solid base with high quality lead in concentrate which is in demand, and on top of that we have a great exposure to silver, which at the moment is a very exciting metal to be in,” said Noon.

For silver, the Sorby Hills revenue stream would be $431m for 14.3 million ounces.

“We have 54 million ounces of silver in our resource making it one of the largest undeveloped resources in Australia and more than most pure silver plays, a fact that has been missed by the market,” Noon, said.

Noon said the prospects for silver are looking positive for the year ahead on rising demand.

“All the indications are there, and we are starting to see the gold to silver ratio pull back in, and we now see the majority of silver’s demand is industrial with large amounts being directed to the manufacturing of solar panels,” said Noon.

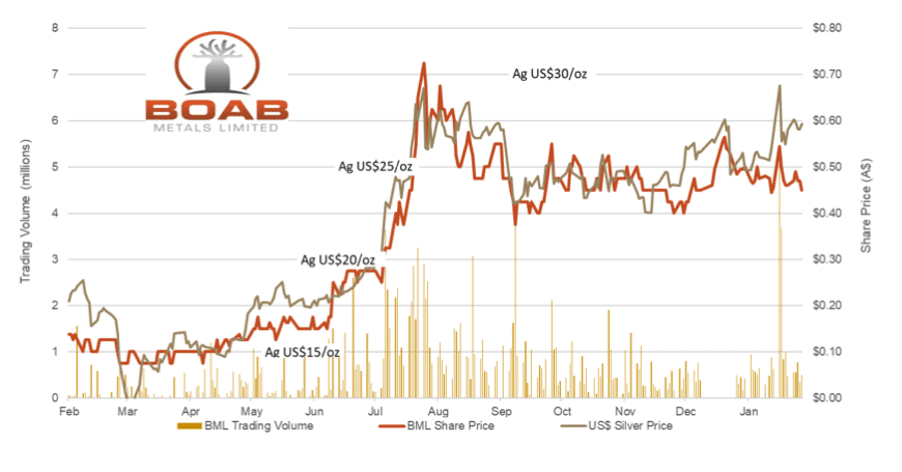

Research by Boab Metals has shown a close relationship between its share price and the price of silver.

Graph showing correlation between Boab Metals’ share price and the price of silver. Image: Terra Studio

This article was developed in collaboration with Stockhead, an advertising partner of Boab Metals at the time of publishing. For further information and to review the original article click here. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.