Boab has increased confidence in its Sorby Hills lead-silver-zinc project in WA’s Kimberley region, moving more of the resource into the measured and indicated categories.

The update, which followed the Phase IV drill program, has converted 4Mt of indicated resources into measured resources, which now stands at 11.1Mt grading 3.6 per cent lead, 0.3 per cent zinc and 45 grams per tonne (g/t) silver.

This is expected to lead to a significant increase in proved reserves with the data feeding into open pit and process plant design criteria for the Sorby Hills definitive feasibility study.

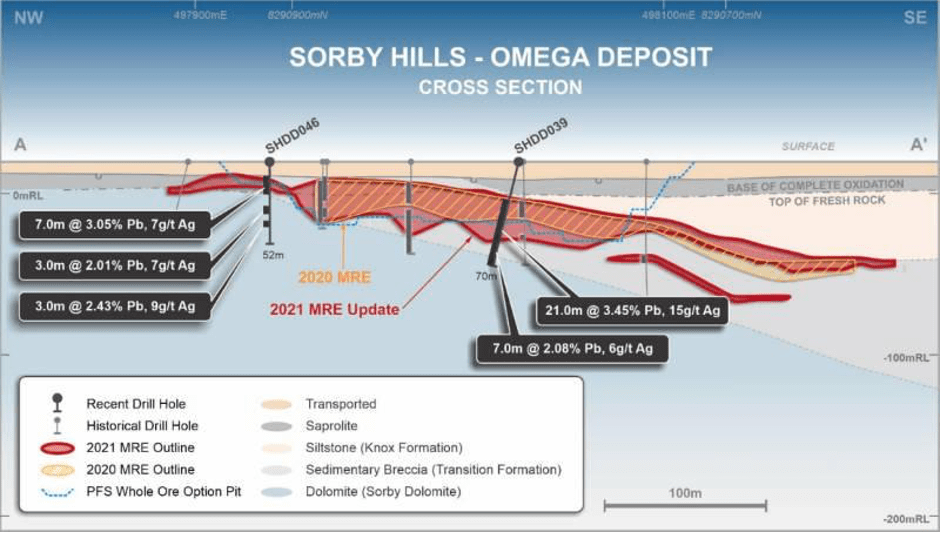

Adding interest, the Boab Metals (ASX:BML) update has increased the resources at shallow depths – less than 60m – in the B deposit and Omega South by 19 per cent, which is expected to positively impact on the Sorby Hills reserve in the DFS.

The Phase IV drilling had returned results such as 11m at 4.69 per cent lead and 15 grams per tonne (g/t) silver from 72m and 9m at 4.37 per cent lead and 26g/t silver from 64m.

Managing director Simon Noon said the Phase IV drilling program has achieved its goal of collecting the geotechnical and metallurgical samples required to underpin high quality DFS open-pit and process plant design as well as increasing geological confidence in the Sorby Hills resource.

“Additionally, the mineral resource estimate has afforded us the opportunity to further refine our geological model and has confirmed high impact targets for future drilling,” he added.

“We’re excited about the upcoming Phase V drilling program which will build upon the current mineral resource estimate and aggressively target opportunities to extend the project life and expand process plant capacity ahead of a decision to mine at Sorby Hills.”

Cross section showing new shallow resources at the Omega deposit of Boab’s Sorby Hills project. Pic: Supplied

Sorby Hills

Sorby Hills now has an overall resource of 44.9Mt at 3.2 per cent lead, 0.5 per cent zinc and 37g/t silver, up slightly from the previous estimate of 44.1Mt at 3.3 per cent lead, 0.5 per cent zinc and 38g/t silver.

The pre-feasibility study has projected that the project could generate net present value (NPV) and internal rate of return (IRR) of $303m and 46 per cent respectively with payback expected within 1.6 years.

Both NPV and IRR are measures of a project’s profitability.

This article was developed in collaboration with Stockhead, an advertising partner of Boab Metals at the time of publishing. For further information and to review the original article click here. This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.