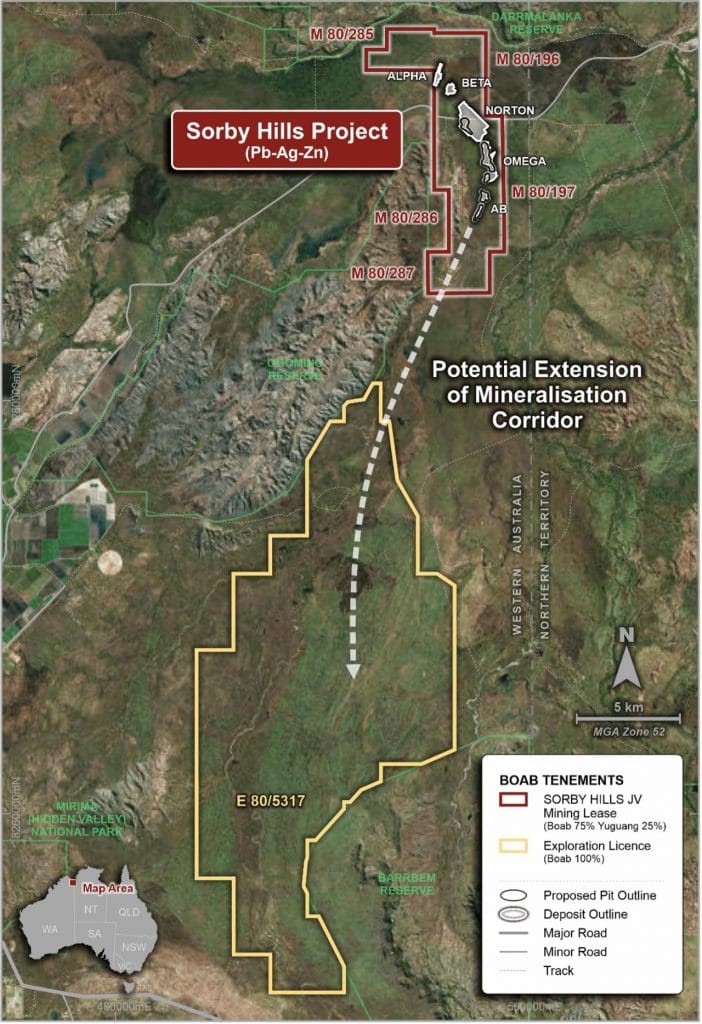

Boab Metals Limited (ASX: BML) (“Boab” or the “Company”) is pleased to announce the commencement of the Phase V diamond drilling program at the Sorby Hills Lead-Silver-Zinc Project (“Sorby Hills”, or the “Project”) located in the Kimberley Region of Western Australia (Figure 1).

HIGHLIGHTS

- Phase V drilling program has commenced at Sorby Hills with a primary objective of investigatingopportunities to extend mine life and increasing the proposed production capacity.

- Minimum of 48 holes comprising 4,200m plannedwith an option to extend the program to follow up prospective targets arising from the initial round of drilling.

- The Phase V drilling program will include:

- testing high impact targets identified in the Phase IV drilling program located proximal to the current Sorby Hills open-pit designs;

- infill and extensional drilling of the Zinc-rich Alpha and high Silver Beta deposits for the first time since Boab’s acquisition of the Project in 2018;

- Further drill testing of the Lead mineralisation previously intersected at the Wildcat target, andinaugural testing of the highly prospective Eight Mile Creek Project, located immediately south of Sorby Hills.

Boab Managing Director and CEO Simon Noon stated:

“We are extremely excited by the potential of our Phase V drilling program. With our metallurgical and geotechnical drilling complete, a current mine plan underpinned 92% by Reserves and nearly A$14M in cash on hand, we are in a great position to aggressively focus drilling metres toward adding tonnes and grade to our Sorby Hills mining inventory and testing the blue-sky perspectivity of our Eight Mile Creek Project.

We look forward to providing updates as the Phase V drilling program progresses.”

Phase V Drilling Program

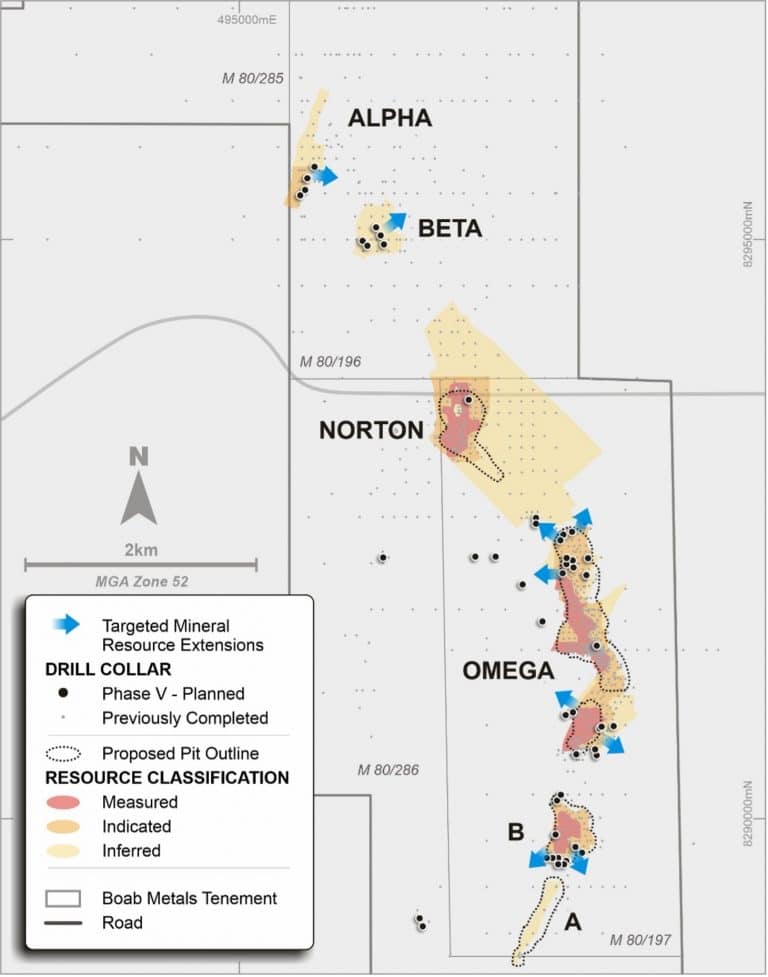

Boab’s Phase V drilling program will seek to extend the Sorby Hill’s Definitive Feasibility Study (“DFS”) mine life and proposed production capacity by a combination of drilling high impact targets proximal to the current open-designs and further investigating the Zinc-rich Alpha and high Silver Beta deposits which to this point in time have not been included in the Project’s mining inventory (Figure 2).

A minimum of 48 holes (4,200m) are planned with an option to extend the program to follow up any significant intercepts arising from the initial round of drilling.

Near Pit targets

The Phase V drilling program will leverage off the results and information derived from the recently completed Phase IV program (ASX release 8 February 2021) that saw a 56% increase in Measured Resources at Sorby Hills (Table 1, ASX release 6 April 2021).

The primary focus of the Phase V drilling program will be to test and validate the interpretation of portions of the Sorby Hills Resource located near but outside the current open-pit designs with a view to incorporating these prospective tonnes into the DFS mine plan.

Near pit targets will include shallow, high-grade portions of the Sorby Hills deposit presently not included in the Mineral Resource or mining inventory.

Alpha and Beta Deposits

The Alpha and Beta deposits include some of the highest-grade Silver results across Sorby Hills with attributed Resources of 2.0Mt at 5.0% PbEq. (3.1% Pb, 1.0% Zn and 67g/t Ag) and 3.3Mt at 6.3% PbEq. (4.6% Pb, 0.4% Zn and 61g/t Ag) respectively based on a 1% Pb cut-off envelope. At Alpha, a steeply southeast dipping Zinc-rich ore body is known to occur with an Inferred MRE of 1.3 Mt @ 4.0% Zinc (Pacifico 24th August 2018). The zinc mineralisation is hosted in a northeast striking fault, with the lead mineralisation contained in stratabound mineralisation in the hanging wall. The planned drill holes will aim to intersect both mineralisation zones.

The drilling of Alpha and Beta will be the first time the deposits have been targeted by Boab since acquiring the Project in 2018.

The Alpha and Beta deposit have not previously been included into the Sorby Hills mine plan as the Company focused on those deposits located within the Environmental Protection Authority (EPA) approved development area aiming to fast track development.

Drilling of the Alpha and Beta deposits represents a significant and relatively low-risk opportunity to materially extend the Sorby Hills mine life.

Wildcat Target

Boab has planned one verification diamond drill hole to test the RC (reverse circulation) drill hole results that followed up an historic intercept. Shallow-depth supergene mineralisation was intersected by Boab in the area commencing from 10m below surface.

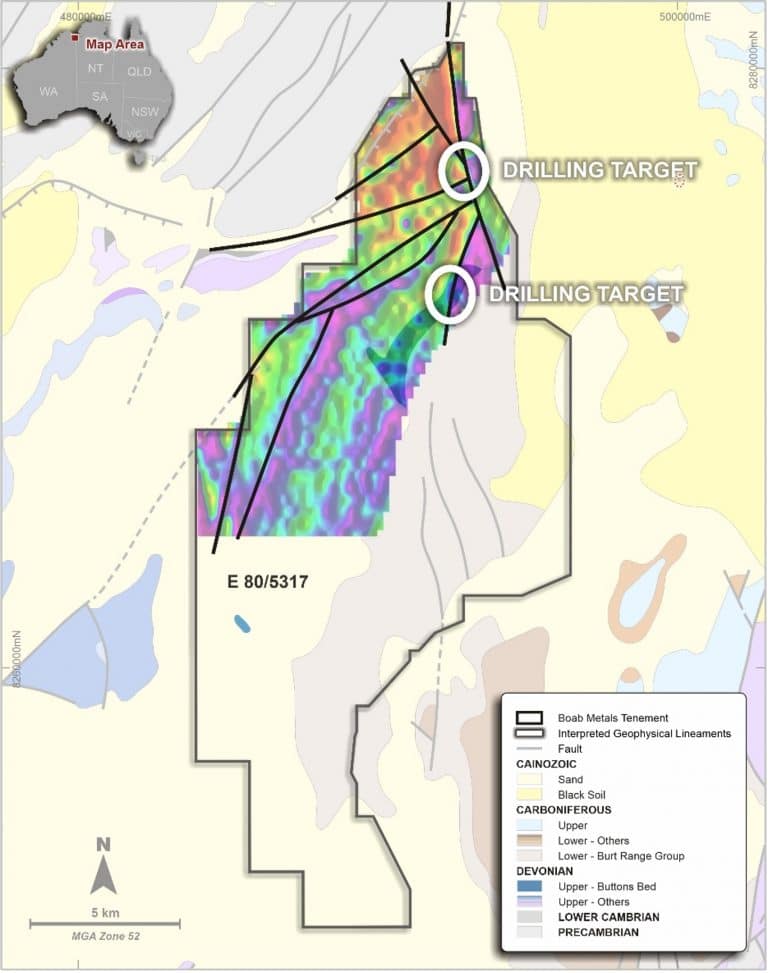

Eight Mile Creek

The Eight Mile Creek exploration tenement (E80/5317) was granted to Boab in April 2020 (ASX release 21 April 2020). The tenements cover 217km2 and include 30km of geological strike prospective for deposits similar to those found at Sorby Hills immediately to the north (Figure 3).

Targets identified via a high-resolution gravity survey conducted by the Company over the tenement will form the basis of the greenfield exploration. Previous drilling campaigns across the Sorby Hills mining tenements have confirmed gravity data as a successful vector toward economic mineralisation in the region.

Boab’s inaugural exploration program for E80/5317 will aim to test outstanding structural targets as well as the development and preservation of prospective Devonian-Carboniferous stratigraphic contact (Figure 3).

The planned drill program is scheduled to be completed by early July 2020 with assays to follow. The Company looks forward to providing updates on the progress of the Phase V drilling program.

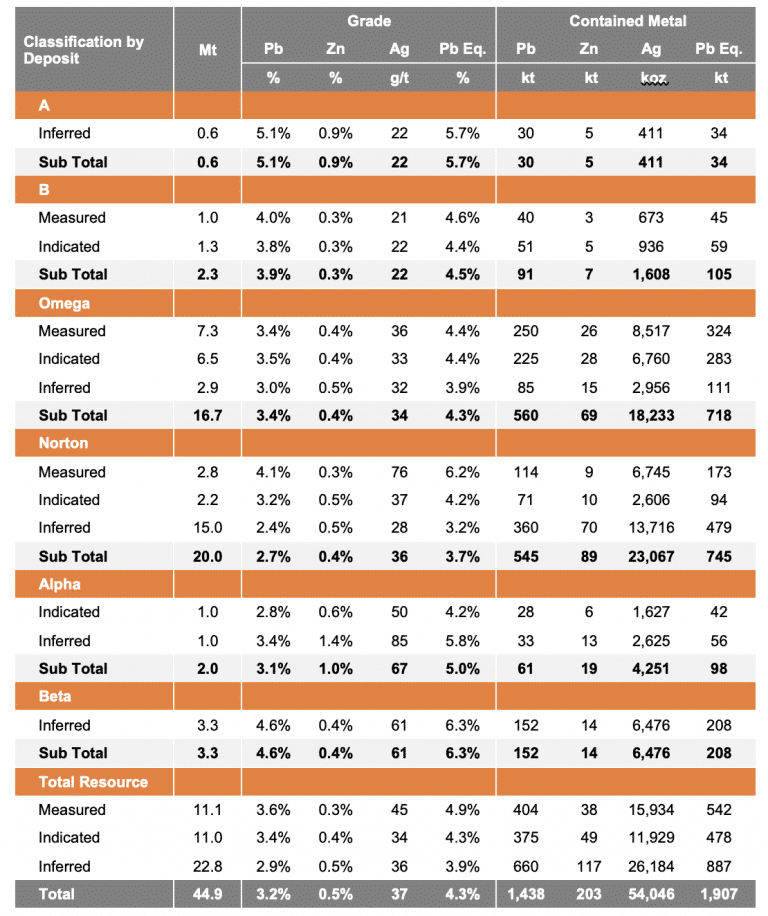

Table 1: Updated Sorby Hills Mineral Resource Estimate – Pb Domains only.

Discrepancy in calculated Contained Metal is due to rounding.

See Appendix 2 for Lead Equivalent calculation method.

Lead Equivalent calculation excludes Zinc.

The Managing Director has authorised this announcement for release to the market.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Simon Noon

Managing Director & CEO

Phone: +61 (0)8 6268 0449

Email: info@BoabMetals.com

About Boab Metals Limited

Boab Metals Limited (“Boab”, ASX: BML) is a Western Australian based exploration and development company with interests in Australia and South America. In Australia, the Company is currently focused on developing the Sorby Hills Lead-Silver-Zinc Joint Venture Project in WA. Boab owns a 75% interest in the Joint Venture with the remaining 25% (contributing) interest held by Henan Yuguang Gold & Lead Co. Ltd.

Sorby Hills is located 50km from the regional centre of Kununurra in the East Kimberley and has existing sealed roads to transport concentrate from site to the facilities at Wyndham Port, a distance of 150km. Established infrastructure and existing permitting allows for fast-track production.

Compliance Statement

The Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (the ‘JORC Code’) sets out minimum standards, recommendations and guidelines for Public Reporting in Australasia of Exploration Results, Mineral Resources and Ore Reserves.

The information in this release that relates to Exploration Results is based on information prepared by Dr Simon Dorling. Dr Dorling is a member of the Australasian Institute of Geoscientists (Member Number: 3101). Dr Dorling has sufficient experience which is relevant to the style of mineralization and type of deposit under consideration and to the activity which they are undertaking to qualify as a Competent Person as defined in the 2012 Edition of the JORC Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. Dr Dorling consents to the inclusion in the release of the matters based on their information in the form and context in which it appears.

Information included in this presentation relating to Mineral Resources has been extracted from the Mineral Resource Estimate dated 6 April 2021, available to view at www.boabmetals.com.au. The Company confirms that it is not aware of any new information or data that materially affects the information included in the Mineral Resource Estimate and that all material assumptions and technical parameters underpinning the estimates, continue to apply and have not materially changed. The Company confirms that the form and context in which the Competent Person’s findings are presented have not been materially modified from the Mineral Resource Estimate.

Information included in this presentation relating to Ore Reserves, Production Targets and Financial Forecasts has been extracted from the Pre-Feasibility Report and Ore Reserve Statement dated 25 August 2020, available to view at www.boabmetals.com.au. The Company confirms that it is not aware of any new information or data that materially affects the information included in the Ore Reserve Statement and that all material assumptions and technical parameters underpinning the estimates, production targets and financial forecasts continue to apply and have not materially changed. The Company confirms that the form and context in which the Competent Person’s findings are presented have not been materially modified from the Ore Reserves Statement.

Appendix 1 – Metal Equivalent Calculation Method

The contained metal equivalence formula is based on the Sorby Hills PFS including:

- Lead Price US$2,095/t;

- Lead recovery of 93.3% (weighted average of oxide and fresh Pb recoveries);

- Lead Payability rate of 95%;

- Silver Price US$21.1/oz;

- Silver recovery of 80.3% (weighted average of oxide and fresh Ag recoveries); and

- Silver Payability rate of 95%.

It is Boab’s opinion that all elements included in the metal equivalent calculation have a reasonable potential to be recovered and sold. The formula used to calculate lead equivalent grade is:

MetalEq (%) = Gpri + (Gpri × [∑i Ri Si Vi Gi ]/(Rpri SpriVpriGpri))

where R is the respective metallurgical metal recovery rate, S is the respective smelter return rate, V is metal price/tonne or ounce, and G is the metal commodity grade for the suite of potentially recoverable commodities (i) relative to the primary metal (pri).

Metal equivalents are highly dependent on the metal prices used to derive the formula. Boab notes that the metal equivalence method used above is a simplified approach. The metal prices are based on the PFS values adopted and do not reflect the metal prices that a smelter would pay for concentrate nor are any smelter penalties or charges included in the calculation.

Owing to limited metallurgical data, zinc grades are not included at this stage in the lead equivalent grade calculation.